Featured

S&P Gsci Crude Oil Index Excess Return

S&P Gsci Crude Oil Index Excess Return. The chart is intuitive yet powerful, customize the chart type to view candlestick patterns, area, line. Investing.com australia user's sentiments for the s&p gsci crude oil index excess return breaking news get actionable insights with investingpro+:

Dive deeper on ixic with interactive charts and data tables spotlighting movers, gainers and losers. Esta página contiene las últimas noticias sobre el etf ipath s&p gsci crude oil total return. Index news nov 14, 2019;

Sentimen Pengguna Investing.com Untuk S&P Gsci Crude Oil Index Excess Return.

Historical data, charts, technical analysis and others. Find the latest information on s&p gsci excess return (^spgscip) including data, charts, related news and more from yahoo finance. Treasury bills and other short term bonds/cash.

Spot Returns Only Reflect Prices Levels Of Futures Contracts Included In The Index.

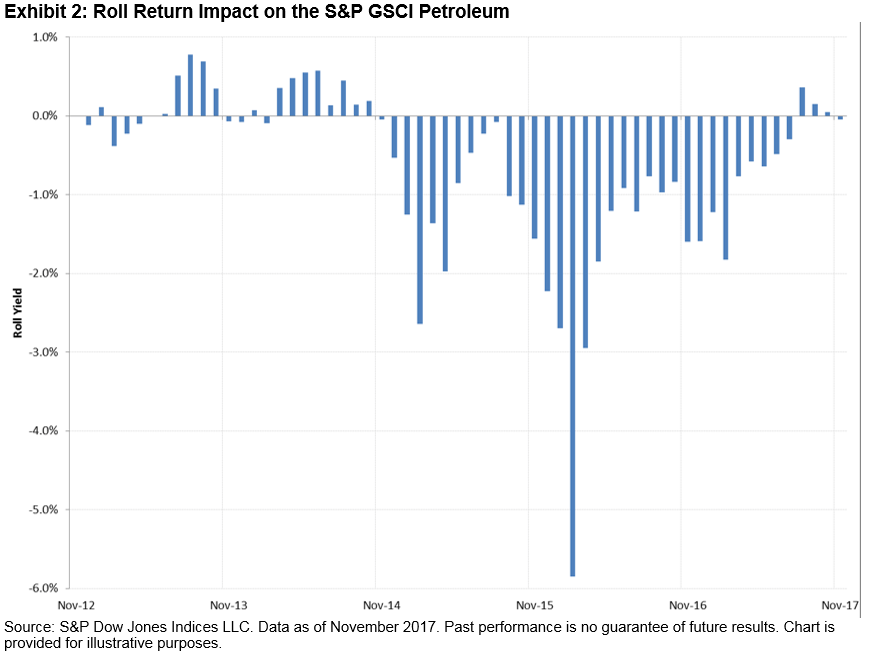

Spot returns are used as a calculation component of the excess returns that add rolling returns and total returns that also include collateral yield. All information for an index prior to its launch date. This index is composed entirely of wti crude oil futures contracts and is derived by reference to the price levels of the futures contracts on a single commodity as well as the discount or premium obtained by “rolling” hypothetical positions in such contracts forward as they approach.

Dive Deeper On Ixic With Interactive Charts And Data Tables Spotlighting Movers, Gainers And Losers.

The index includes the same futures contracts as the s&p gsci although contract months vary and the return values differ. Get instant access to a free live s&p gsci crude oil index excess return streaming chart. Crude oil falls 8%, s&p 500 drops 0.9%.

More Information Is Available In The Different Sections Of The S&P Gsci Crude Oil Index Excess Return Page, Such As:

The index launch date is may 01, 1991. Crude oil 98.27 +1.01 (+1.04%) gold +15.10. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

Comprehensive Information About Etfs And Futures Indices Which Are Interrelated To S&P Gsci Crude Oil Index Excess Return.

Review of 2022 s&p gsci index rebalancing read. Start 7 day free trial register here See each day's opening price, high, low, close, volume, and change %.

Comments

Post a Comment